European biomarket 2025: recovery, growth and opportunities

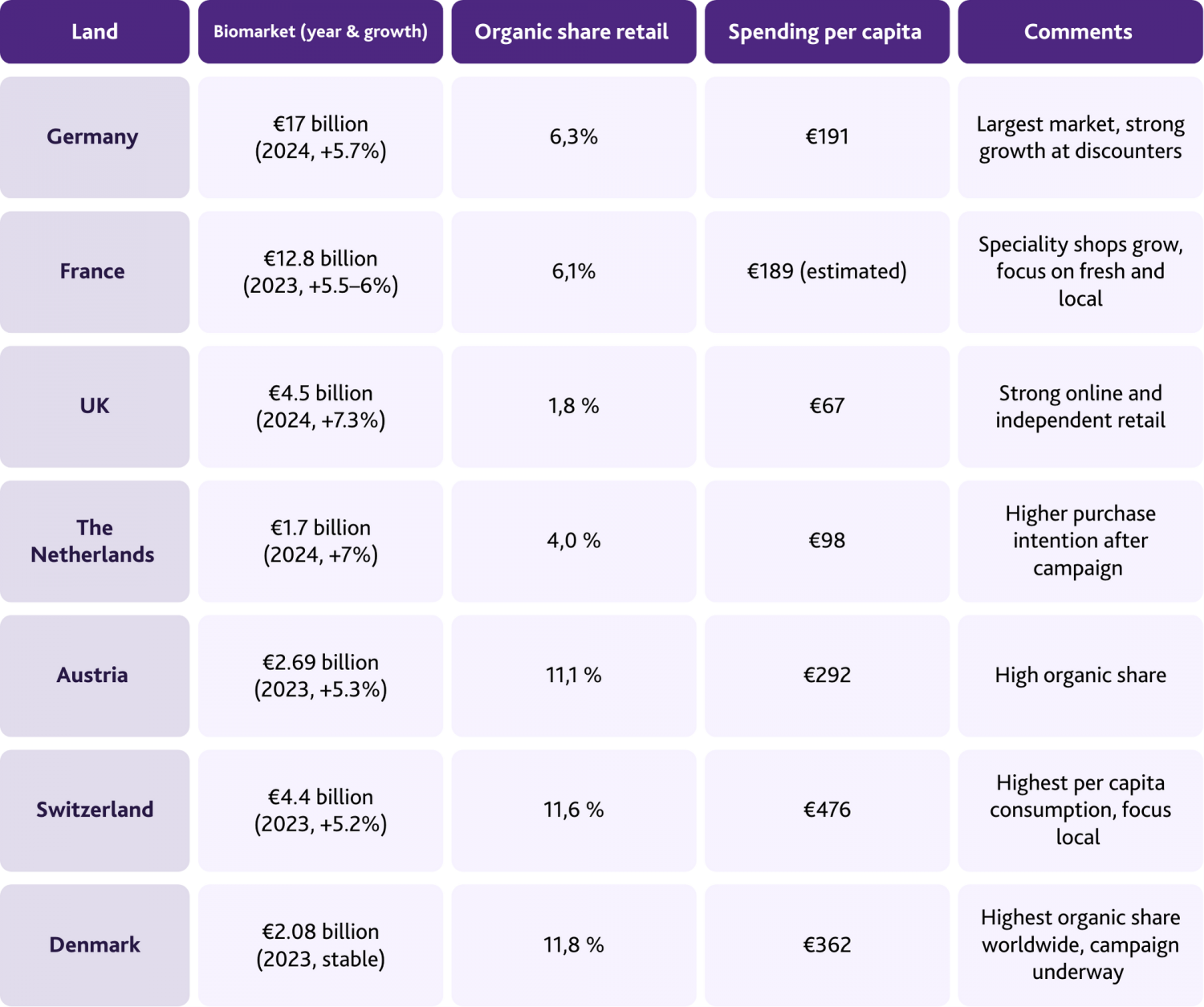

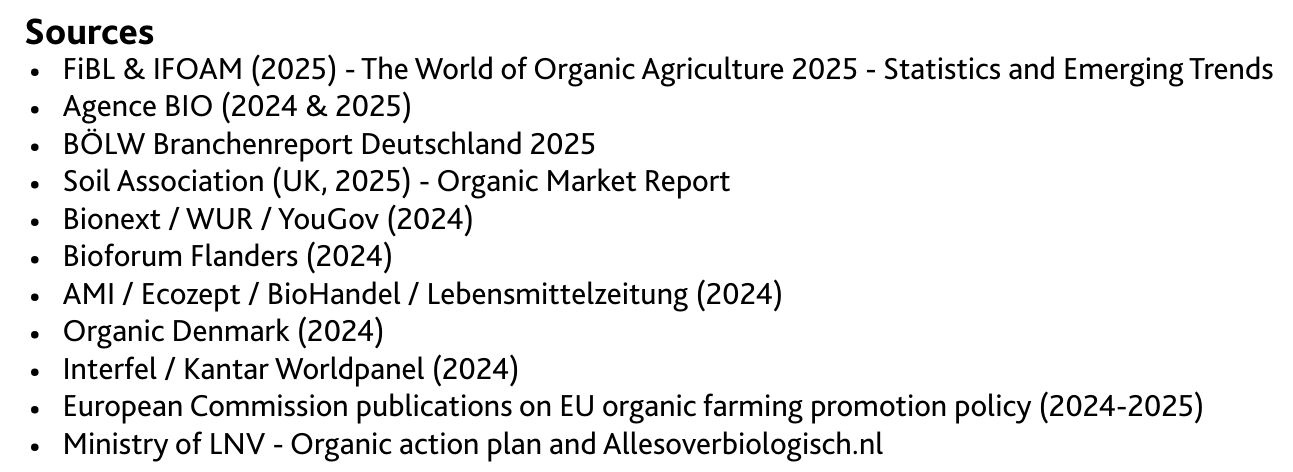

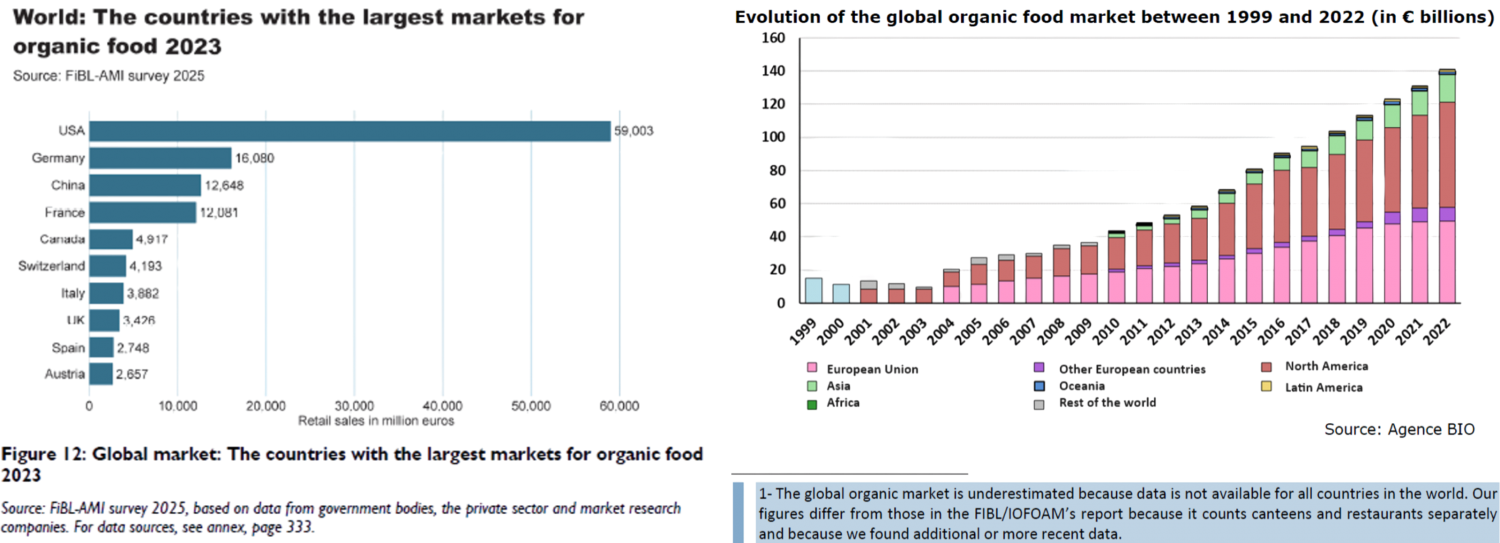

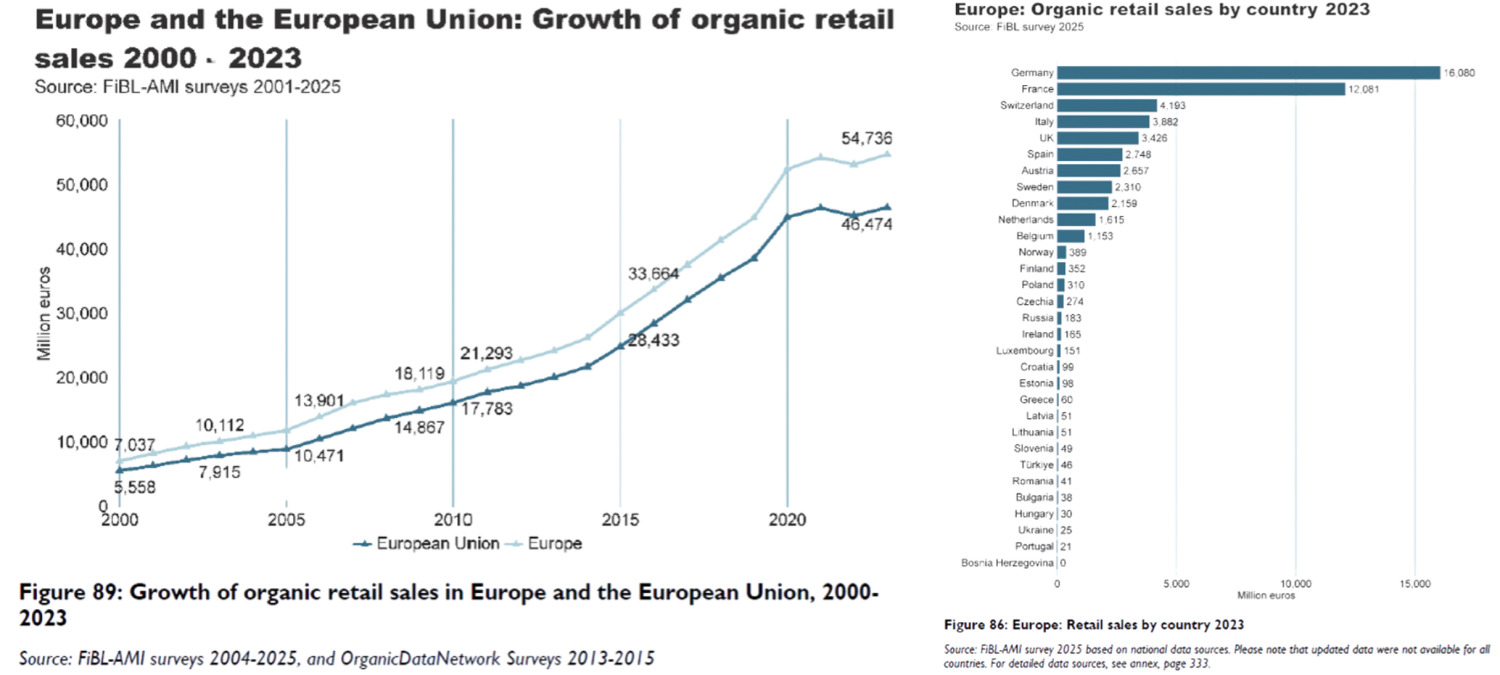

The European organic products market has returned to a growth path in 2023 and 2024 after the dip in 2022. With sales of €54.7 billion in 2023 (of which €46.5 billion within the EU), Europe represents 40.9% of global organic consumption - just behind North America.

That position is supported by the fact that seven of the 10 largest bio countries worldwide are in Europe.

The largest markets in Europe are Germany, France, Switzerland, Italy and the UK. Together, they account for two-thirds of European organic sales.

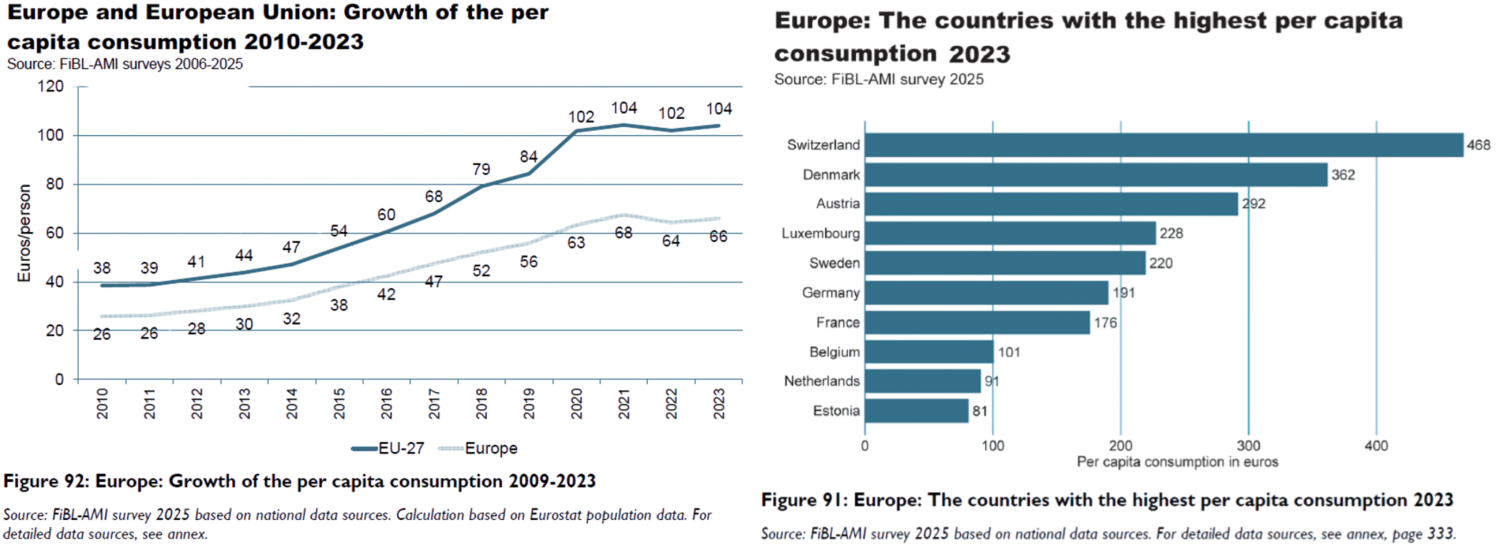

In 2023, Europeans an average of €66 per person on organic food (EU - member states: €104). In Switzerland and Denmark, this was as high as €468 and €362 per capita, respectively.

Incentive from EU and national policies

The European Commission is also investing heavily in the promotion of organic products in 2025. €132 million is available for campaigns inside and outside the EU, focusing on sustainability, organic production and EU quality labels.

An example is a promotion of organic soft fruit (2025-2027) in the Netherlands, Belgium and Germany, with an annual budget of €400,000.

National governments are also actively pursuing bio:

- France: campaign C'est BIO la France! (#Ayons le bioreflexe) launched in 2025, €4.6 million budget, as part of Ambition Bio 2027 (goal: 18% bio area by 2027)

Netherlands: campaign Alles over biologisch (2024-2025) within the Organic Actionplan (target: growth from 4.5% to 15% organic area in 2030). €76 million available.

EU campaign "The most beautiful message is organic" ran from 2022 to 2025 in the Netherlands, Belgium, Sweden and Finland.

Germany: target 30% organic by 2030, supports supermarket campaigns (such as Netto BioBio, Penny Naturgut), cooperation with WWF and education programmes, among others.

Denmark: new nationwide organic campaign planned for 2025, focusing on young people and Ø-label. Previous campaigns such as 'Pure Food Joy' (2017-2020) were very successful....

- Sweden and Norway: run structural campaigns through industry associations and public institutions such as schools and hospitals.

Germany: largest European biomarket continues to grow

- €17 billion sales in 2024 (+5.7%); volume in H1 2024 +10% vs 2023

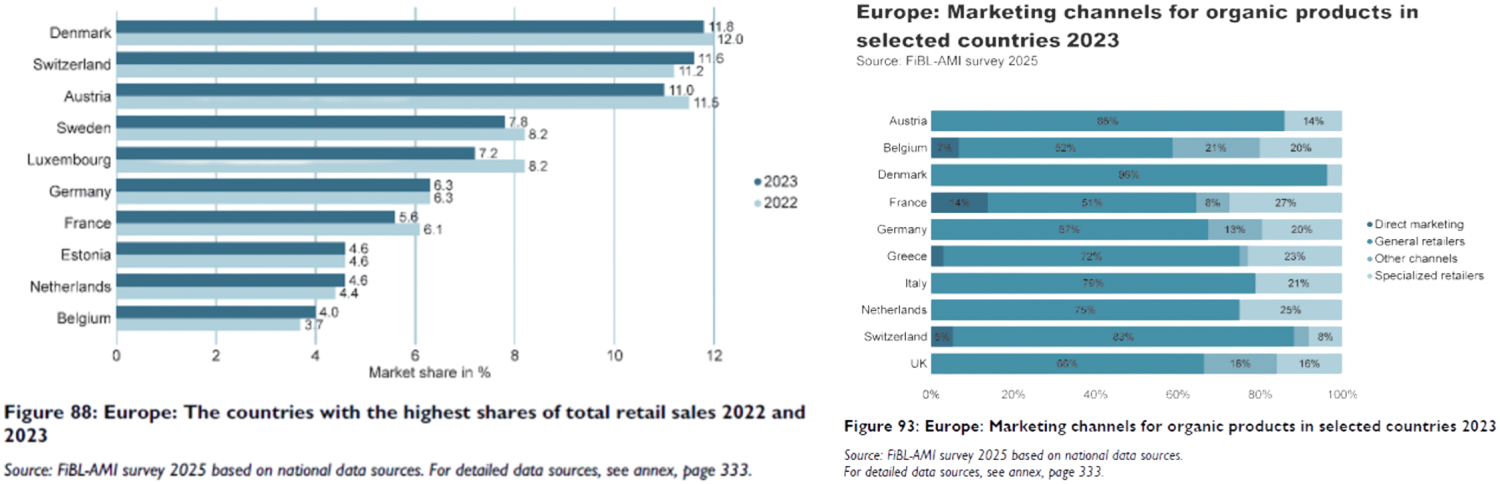

- 69% of sales through supermarkets, drugstores and discounters

- Discount growth through expansion of private labels and collaborations bio producer associations.

- Organic specialty shops recovered slightly in second half 2024

- Fruit and vegetables one of most popular categories

- Agricultural area: 11.4% (2024)- still far from target 30% by 2030

- Buying motives: health, animal welfare, sustainability - price sensitivity remains challenging

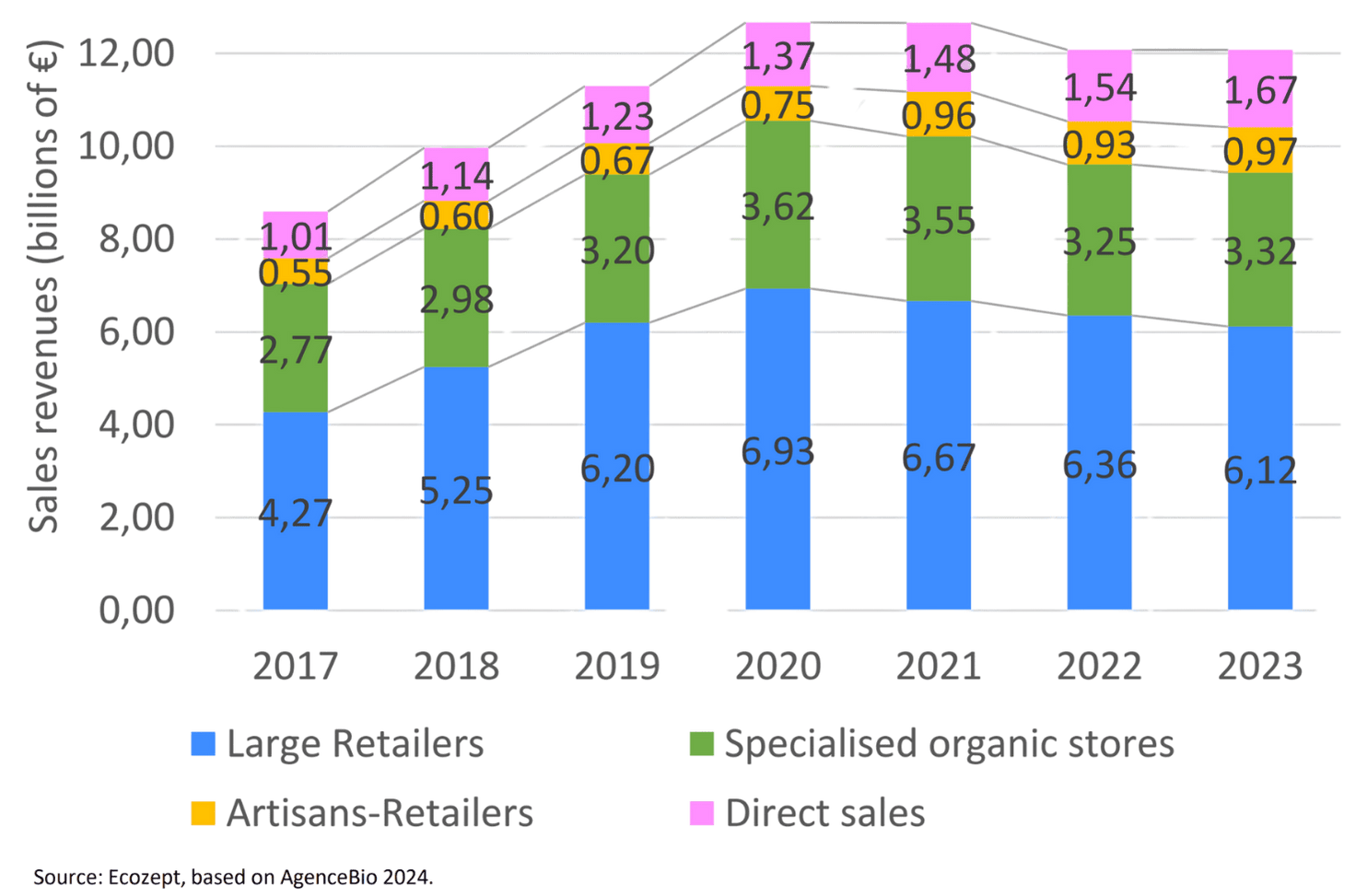

France: revival through speciality shops and direct sales

- Number four worldwide for bio

- Biomarket growth in 2024: +5.5-6%

- Supermarkets shrink range (-8.7%), while organic specialty shops (+8.4%) and direct sales (+3%) grow

- +15% turnover in fresh organic fruits and vegetables due to smaller price differences compared to conventional ones

- Citrus and bananas: largest share of imported biofruit

Austria, Switzerland: leaders in organic share

- Austria: 11.1% organic share by 2023, +5.3% sales growth, major exporter (including dairy). Fruit and vegetables key categories.

- Switzerland: highest organic retail share in the world (11.6%) and €476 per capita in organic spending. More than 50% of households buy organic several times a week. Market dominated by COOP and Migros.

Netherlands and UK: recovery continues

- Netherlands

+7% turnover and volume in 2024

44% of households regularly buy organic

4% market share, accounting for €1.7 billion

38.5 purchase frequency

- UK

+7.3% growth by 2024, £3.7bn (€4.5bn)

13th consecutive year of growth

Bio volumes grew 4x faster than conventional

23% of supermarket organic purchases via online

+9% sales growth in independent stores

Continued government commitment to promotion. But only 3% organic farming area

Conclusion

The European biomarket clearly recovered in 2023 and 2024, with positive prospects for 2025. Despite differences between countries, health, sustainability and animal welfare are universal drivers.

Discounters and supermarkets are the main sales channels, but organic specialty shops are gaining ground again. At the same time, organic farming acreage lags behind consumption growth, which could lead to future shortages.

Promotion campaigns - both from Brussels and nationally - therefore play a key role in strengthening awareness as well as supply.

Biomarket overview Europe